Heavy users are the small portion of purchasers of a brand that, because of how much they consume or use, account for a majority of a brand’s sales. They are loyal to the brand in that they choose the brand over others in the market and are often the first to try new brand offerings. But finding the right initiatives to grow sales with them requires understanding who they are, what they love about the brand and what attributes are missing for them.

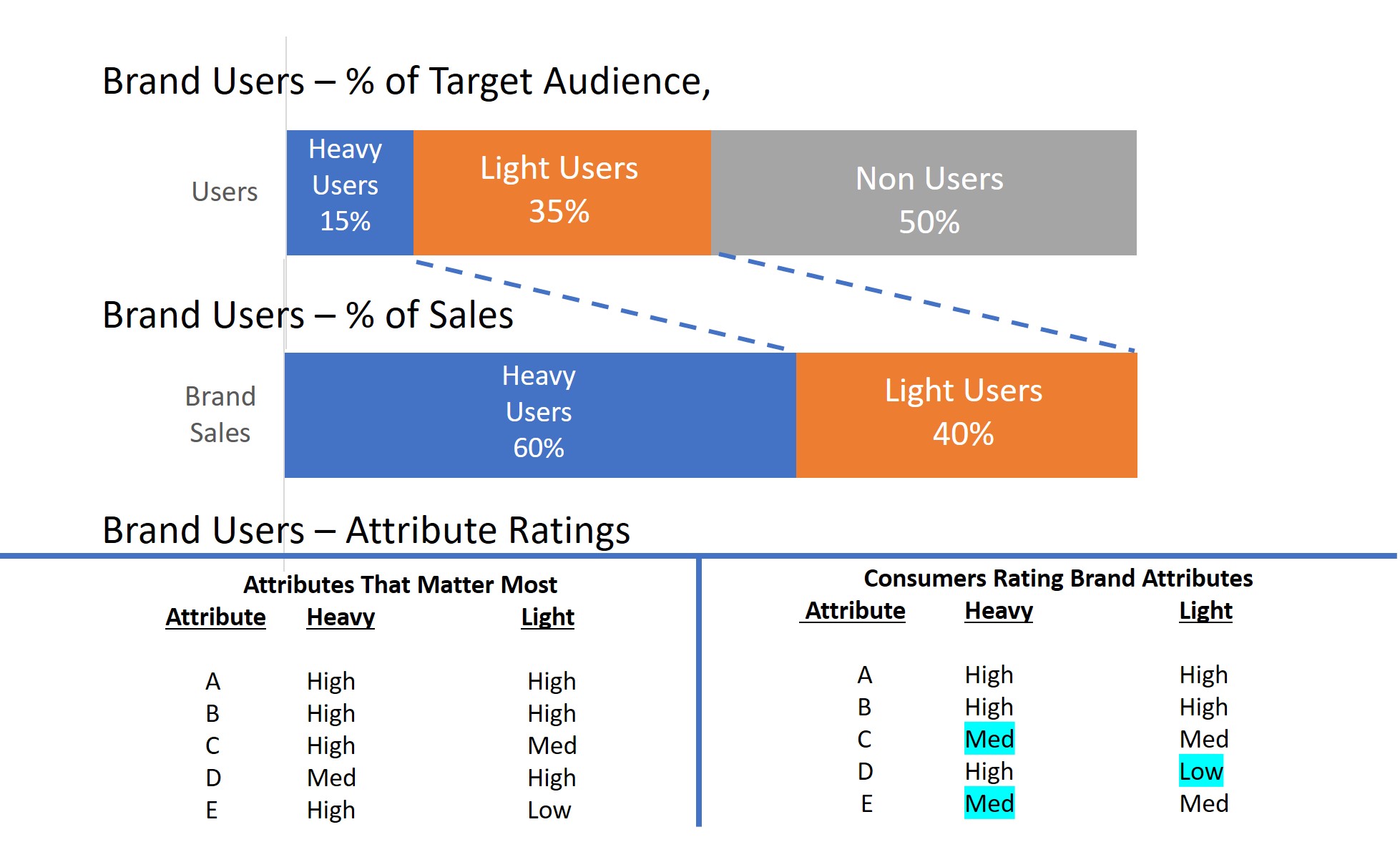

Several years ago, I was a marketer managing a well-known national food brand. Our research uncovered that over 60% of the brand’s sales were coming from less than 5% of the target population and about 15% of the brand’s overall users. I’ve always known that loyalty was important, but that concentration was startling.

Independent research suggests that heavy users account for about 50% of brand sales. Not the Pareto rule of 80/20, but still significant for such a small group. So how do you find your brand’s heavy users? There are two approaches:

1. First define what level of consumption makes up “heavy” usage. How many purchases across a specific time period.

2. Shopper and household panel data from 3rd party sources such as IRI and Nielsen to find how many households fit that description

3. You can also use a simple questionnaire among the general population or among your target and ask quantities and frequency. While you are at this, find out how many light and non-users there are and find some demographic data.

Building ideas to stimulate additional purchase requires additional research to understand how they interact with your brand. Building a list of brand attributes can provide a rich understanding and lead to consumer insights. Face-to-face focus groups and social media discussions allow heavy users to share the attributes of the brand.

Brand attributes come in three types:

1. Functional attributes – functions of the brand (for food products that could include flavor, sweetness, crunchy, etc. whatever is important in your category).

2. Benefit attributes include items such as safety, convenience, quality, consistency; items directly resulting from physical attributes.

3. Aspirational attributes like “a quality brand”, “a brand for me”, “comforting”, “makes me feel like a good mom”, etc, – emotional benefits that come from using brands in your category.

Once qualitative work uncovers the most important attributes of a brand, use a quantitative study to rank the importance of various attributes of the brand. The quantitative ranking allows you to find which attributes are most important and how well your product delivers. Heavy users will rate quality and consistency very high. It is important not to underestimate these attributes for heavy users.

There are several “go-to” types of activities that grow market share among heavy users:

•New flavors (variety) to explore

•Expanded occasions – offerings that allow consumers to use items in other parts of their day, such as on-the-go, at the office.

•Larger and multi-portion packs offering a better value

•New places to find your brand

•Non-price related promotions that require an extra purchase

Heavy users are loyal. They value the consistency of the experience and quality you deliver. They are not looking for change that disrupts how they enjoy your brand. But they like to be surprised and delighted from time to time with improvement based on their lifestyle needs as long as the core products they love don’t change. Incremental purchase opportunities can cause big gains for your brand among this core group.