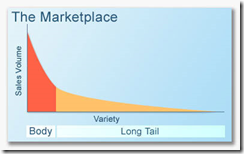

The Long Tail theory was developed by Chris Anderson, who first published the idea in 2004 in Wired magazine, and then went on to publish his 2006 bestselling book. His theory was that when consumers were given unlimited  access to variety of products (easy to do in an online world) – they would tend to migrate to more targeted offerings that were previously unavailable to them (in the “tail” of the sales curve). While sales of individual products in the tail would be small, the huge selection would bring in more sales overall. It became known as the “profitable tail” in corporations as these items could be more profitable on a per unit basis. The tail was a low volume, high profit model. And for retailers like

access to variety of products (easy to do in an online world) – they would tend to migrate to more targeted offerings that were previously unavailable to them (in the “tail” of the sales curve). While sales of individual products in the tail would be small, the huge selection would bring in more sales overall. It became known as the “profitable tail” in corporations as these items could be more profitable on a per unit basis. The tail was a low volume, high profit model. And for retailers like  Amazon, this confirmed their decision to extend the breadth of their offerings rather than consolidating around best sellers. The Long Tail theory was counterpoint to the current market segmentation and portfolio approaches where high market share and high growth were the paths to profitability.

Amazon, this confirmed their decision to extend the breadth of their offerings rather than consolidating around best sellers. The Long Tail theory was counterpoint to the current market segmentation and portfolio approaches where high market share and high growth were the paths to profitability.

An exciting part of Long Tail theory for the providers of these tail products and services was that the barriers of entry into markets would also be lowered in terms of investments in people, resources and discounting. Business segments in which consumers want variety are the supposed winners. Take recorded music and books as examples – traditional publishing / distribution companies currently provide and promote limited variety, then achieve profitable market share dominance when sales exceed relatively high fixed costs. Long tail thinking, however, says anyone can write an e-book, record an album, and be found on the internet. Given access to much more choice, consumers would happily purchase something that perfectly fits their tastes rather than having limited choice. The democratization of the marketplace sounds great, especially if you are a smaller player.

The dilemma for the long-tail entries. Entering a market as an unknown player using long tail-thinking can be treacherous. The price that a vendor can charge if they are only playing in the long tail will gravitate to the costs of goods of the lowest cost provider, which eliminates any chances of profit for any of the players, or even worse, moves prices to zero of free. If recording a piece of music or writing a book has no hard costs (other than the artist’s time and sweat), then pricing for these products will gravitate to zero. Let’s say I was to try to charge people to read this blog. My great points of view as well as my time and energy must be worth at least a penny or two, yet readers have too many other choices for quality content that is free (the tail in blogging is a very long one).

“Free” is a bad pricing model. Working in the long tail is a labor of love, a hobby, maybe a fulfilling way to learn and dream. But the laws of economics (pricing being a function of supply and demand) make it an unprofitable business.

The solution is to stand out. Pricing leverage comes from offering truly unique, differentiated and remarkable products or services. Author Seth Godin has been writing about pushing yourself to stand out in your chosen field (Read Linchpin and The Dip), Mediocre is the risky middle ground that is expendable. Standing out is no longer just a good idea, it is now an imperative. Why? It comes down to pricing power.

Pricing power is everything. To market products or services in the long tail, you must figure out a way to be a price leader – which means charging a fair price for something that is so unique that it has no equal. This is a form of market share leadership – even if the market is tiny. Make no mistake, Seth Godin, Chris Anderson, and even Amazon are market share leaders in their fields which allows them to charge money and make profits selling products. The ease of entry into a category can be deceiving. Offering what is already available, even if you do it really well, will lead to a lack of ability to charge a price that allows you to make money. Focus only on what it takes to be the single best offering that will drive your market share to the top.